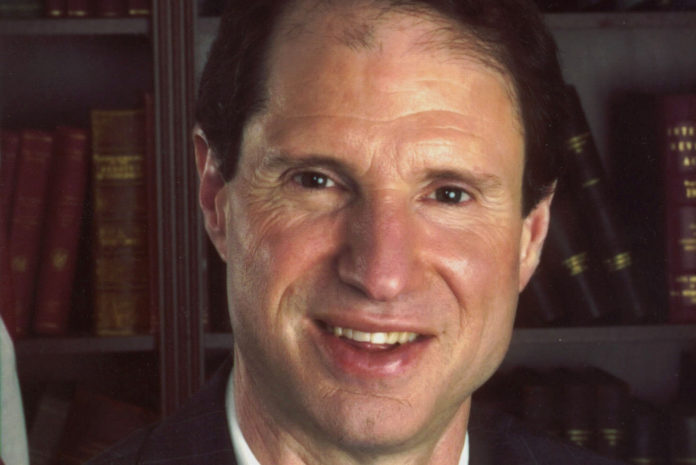

WASHINGTON, D.C. – Senator Ron Wyden (D-OR) today introduced S. 420 as part of a bicameral package of legislation offered in tandem with fellow-Oregonian and Democrat Rep. Earl Blumenauer that seeks to “preserve the integrity of state marijuana laws and provide a path for responsible federal legalization and regulation of the marijuana industry.”

The announcement was made via the newsroom of the Senate Committee on Finance, of which Wyden is the ranking member. It was a fitting move considering the financial bent of the three-bill package, which, in addition to descheduling cannabis, does away with IRC section 280E, the misappropriated tax code that flagrantly “prohibits marijuana businesses from claiming certain deductions and credits for federal tax purposes.”

The Marijuana Revenue and Regulation Act also imposes a significant federal excise tax on cannabis products using the rationale that “alcohol and tobacco products are subject to federal excise taxes.” The proposed tax starts out at ten percent for the first two years and increases not-so-incrementally over the next four years before topping out at 25 percent for all cannabis products, defined in the bill as “any product containing marijuana or a marijuana derivative.”

Legislative text of the Act adds, “Marijuana sold during the sixth and subsequent years would be subject to a per-ounce rate equal to 25 percent of the prevailing price for marijuana in the U.S. during the preceding year. In the case of any marijuana product containing a marijuana derivative, an equivalent rate would apply based on tetrahydrocannabinol (THC) content. This phased-in tax rate is intended to reduce barriers for marijuana businesses moving to the new tax regime. In addition, this framework is intended to accommodate price changes in the marijuana market which are expected as a result of descheduling and regulation.”

This is the second bite at the apple for Wyden and Blumenauer, who introduced comparable legislation in 2017 titled The Marijuana Revenue and Regulation Act (S. 776 and companion bills H.R. 1823 and 1841). In that failed effort, the 25 percent tax rate would have been achieved in five years rather than six.

In a whitepaper on taxes prepared at the time by the National Cannabis Industry Association (NCIA), a trade-off was one the group appeared resigned to accept when it noted that “a federal excise tax on cannabis could be part of a legislative package that includes an exemption from Section 280E of the IRC.” But the trade group also stated unequivocally, “An ultimate federal tax rate of 25%, based on some kind of national average, is excessive and likely to have counterproductive effects on legal cannabis markets.”

That holds equally true in the current environment. In response to today’s announcement, NCIA executive director Aaron Smith commented, “This legislation would be a boon for the cannabis industry and for states that have enacted effective laws, but it is vital that the federal tax rates be established in a way that does not incentivize the continuation of the illicit market. It is equally important that small businesses, which would be disproportionately impacted by heavy federal taxes of any sort, be allowed to stay competitive in the industry. We will continue to work with lawmakers to find a rate that is fair to all parties.” The prepared statement includes a link to the 2017 whitepaper.

In addition to its ambitious tax scheme, which may be intended to grease the interest of reluctant senators, the legislation uses tobacco and alcohol laws as a guide overlaying its “path” to federal regulation. A series of proposed “special rules” for federal permitting, packaging and labeling, advertising, and trade closely mirror regulations used in the other two sindustries. Despite those limitations, many of the proposed legislative changes will be cheered by the American cannabis industry, especially in the matter of international trade: “This section expresses the intent of the United States in trade negotiations to seek removal of barriers to trade in marijuana and marijuana products.”

Another bill in the package, The Responsibly Addressing the Marijuana Policy Gap Act of 2019, attempts to equalize federal and state cannabis policy by removing banking and business barriers, expanding advertising for cannabis products, providing FCC safe harbor for cannabis-related broadcasts, and codifying in law bankruptcy and employment protection, fair access to education, tribal sovereignty, access to federally assisted housing, and an end to unfair deportation and civil forfeiture—all profoundly serious issues.

Still, the legislation fails to explain how it plans to resolve the contradiction inherent in its goal of preserving state law as it lays the groundwork for federal regulation of cannabis and the taxes that come with it. This may be one reason Reason’s Jacob Sullum called the bill “2% Legalization, 98% Taxes and Regulations.”