WESTERN UNITED STATES – In Colorado, the 2020 wildfire season will be remembered for the size of its fires. Prior to 2020, the largest wildfire in the state’s history consumed 137,000 acres. This year, three fires already have blazed through more than 400,000 acres. Fires that burn more than 100,000 acres are designated “megafires.”

The Cameron Creek megafire, which has been burning since mid-August, is Colorado’s largest at 208,913 acres. Currently 97-percent contained, the fire grew so huge at one point that it burned over the Rocky Mountains and caused the closure of Rocky Mountain National Park, which remains closed. The burn area is east of Fort Collins, Colorado, in Larimer County.

The East Troublesome fire, burning just south of the Cameron Peak fire, has damaged more than 193,000 acres and is currently 92-percent contained. The difficulty of the terrain in both fires has made fighting the fires difficult. East Troublesome, like Cameron Peak, burned over the Rocky Mountains. It started in mid-October and the cause is unknown.

Fortunately, the first blasts of winter weather across the Rockies that arrived last week have helped to tamp down the embers.

Despite acreage burned, because the fires were in remote areas, Colorado cannabis farmers have not been affected by actual fire damage, property loss, or evacuations. However, concerns for smoke and ash damage became a reality for some outdoor growers. For Coloradans, the 2020 fire season is evidence of the effects of climate change, foretelling a fiery future.

One thing is clear: historic-sized fires are happening more frequently in the drought-stricken Western United States, where bark beetles have ravaged forests and some areas haven’t burned in generations.

In California, the August Complex fire, which still is not fully contained, has been designated a “gigafire,” which means more than one million acres have burned. There have been few gigafires in modern times; the most recent gigafire in the U.S. was the 2004 Taylor Complex fire in Alaska.

During three of the past four years, historic fires have affected operations in northern California’s Emerald Triangle, a legendary cannabis growing area nestled between wineries and orchards and in forests throughout Mendocino, Humboldt, Trinity, Tehama, Glenn, Lake, and Colusa Counties.

Cannabis brand 22Red was founded by System of a Down bassist Shavo Odadjian (the metal band recently released its first album in fifteen years) and offers a proprietary line of flower strains, vape cartridges, and hemp products. While the company has indoor growing facilities located in California that were not directly affected by the fire, 22Red Chief Executive Officer Harry Kazazian wondered about secondary effects of the 2020 fires. In California, threats from big fires can range from mandatory evacuations to mandatory power outages that last for days or even weeks.

Several big fires have been ignited by power lines that blow into tree limbs during hot, dry, windy weather. Once a fire ignites in heavy wind gusts, it can spread to hundreds of acres in an hour or two, while red-hot embers are carried further afield, sparking more spot fires in dry conditions. Once that happens, evacuations can be imminent.

“The biggest worry for us has always been power issues. What if the fires lead to power outages and then the rolling blackouts? Because with indoor growing, power is important,” Kazazian explained.

“There’s been some interruptions at a few of our places, but they were for, like, an hour or something. Nothing that was, you know, catastrophic. You know what I’m saying? So, that to us is our biggest worry with the fires and power and all this stuff going on.” Generators, he said, were limited as a contingency. A day or two of power outages might be okay, Kazazian said, but a week or more without lights or ventilation would ruin indoor crops.

Kazazian also worries about financial impact due to the fires hitting so close to harvest time. He said he’s already noticed an uptick in the wholesale price of flower.

“We think that [the August Complex fire] has affected [the prices] because it takes so much product offline and, you know, which then drives up everything. The price of indoor [flower] has gone up. We think that because there’s less supply—just economics, right? Supply and demand.”

Adam Koh, editorial director at wholesale price index Cannabis Benchmarks and Hemp Benchmarks, brought to mind that gigantic wildfires weren’t the only natural disaster that occurred in 2020. Along with weather disasters that included fires, floods, and a record-setting hurricane season, the entire planet experienced a global viral pandemic; COVID-19 has changed everyday life for whole industries and populations for the past nine months.

“There was significant uncertainty at the start of the pandemic as to how the cannabis industry would fare as legal cannabis markets have never faced this type of situation, or even a recession, in general,” Koh said. “To this point, it seems that cannabis is a recession-proof commodity along the lines of alcohol.”

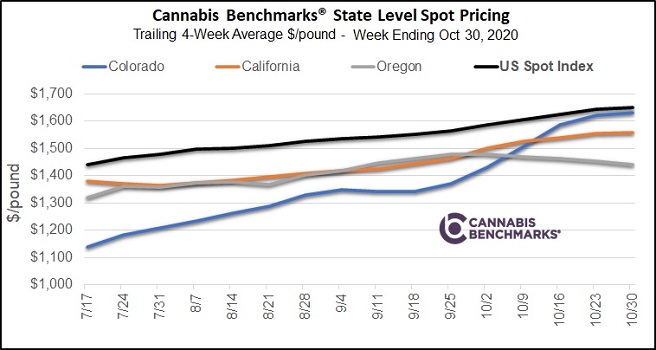

In California, Colorado, Oregon, and Washington state, Koh said, demand for flower has only increased since the beginning of the pandemic in March, and “this is true nearly across the board, from states with recreational legalization like Colorado and Oregon, to medical-only states like Arizona and Oklahoma.”

Nevada is the only legal state that is an exception to this trend, Koh said, due to the precipitous drop in global tourism which has slowed economic recovery in Las Vegas. “Even so, [Nevada] sales as of June have climbed back up to pre-COVID levels even though tourism is still severely depressed, indicating increased sales to in-state residents,” he said.

So, while the U.S. economy is reeling from assaults on multiple fronts, legal cannabis industry sales have been able to remain steady, and even increase.

“Strong sales have persisted even after the expiration of the CARES Act at the end of July, which provided expanded unemployment benefits and other support for people and businesses impacted by the pandemic,” said Koh. “We think that with many activities off-limits due to the virus—like movies, sports games, amusement parks, etc.—people are diverting more disposable income to cannabis.

“Given that demand has held, even as unemployment remains high and there is little to no support from the Federal government, it seems like elevated sales are here to stay,” Koh continued. “Things could change as the pandemic continues to worsen and we enter uncharted territory, but the industry has, for the most part, been designated as ‘essential’ and permitted to continue operating even during shutdowns.”

Koh pointed out that Massachusetts, which ordered adult-use retailers to close from late March to late May as part of its pandemic lockdown, was the only state that initially closed dispensaries for more than a few days.

In conclusion, Koh put 2020’s wholesale cannabis pricing into context: “The U.S. Spot Index as of October is the highest it’s been in over three years,” he said. “Also, it has risen by about $300 per pound, or 22 percent, from the final week of March, when most states had initiated lockdowns due to the virus, to the final week of October; from $1,357 to $1,658 per pound of flower.”

One thing is certain, it’s too early to assess the affects of multiple disasters on the 2021 legal cannabis crop, and even harder to predict how the laws of supply and demand will effect prices in the coming months.