The people, the products, the progress and the trends that keep the vape business burning!

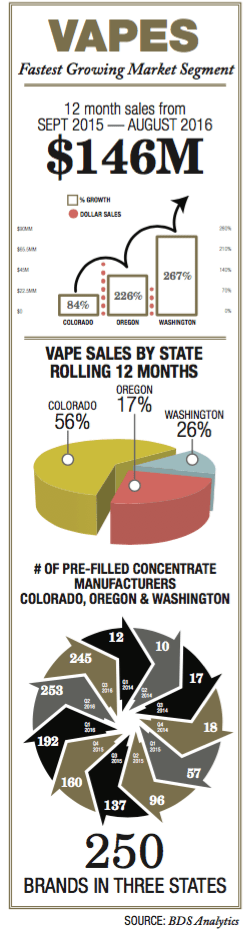

According to BDS Analytics, 2016 was a year of solid growth for the overall vape sector. In fact, judging by the company’s data for more than 600 dispensaries and more than 50 million transactions, Director of Dispensary Relations Greg Shoenfeld said some vape sub-categories are exploding. For example, sales of vape cartridges in Colorado, Oregon, and Washington alone reached $146 million, a whopping 132-percent increase year-over-year.

“The rapid growth within the category has led to the proliferation of brands and products,” said Shoenfeld. “In 2016, BDS dispensary partners have sold vape products from over 200 brands.”

And that’s just the tip of the iceberg. With multiple recreational and medicinal initiatives approved by voters in November, dispensary owners are scrambling to acquire more square footage and/or expand to additional locations in order to keep up with all the new products looking for homes on their shelves. Pep “Blackbeard” Tintari, who founded the Greenlight Discount Pharmacy in Sylmar, California, just bought the retail store next door because “the competition is only going to get fiercer,” while Studio City’s popular Buds and Roses dispensary is looking to carve out the proper retail space to maximize efficiency in all departments in order to keep a steady customer flow. This is potentially good news for vape companies.

Where the sales are

Currently, Washington dispensaries sell the most vapes. According to BDS, the state’s cannabis retialers enjoyed a 267-percent increase in sales from August 2015 to August 2016, while Colorado saw an 84-percent increase. Oregon, once a hot vape market, did not grow as much due to changes in testing requirements for concentrated oils.

“In 2017, we expect to see vape sales in Colorado, Oregon, and Washington exceed a billion dollars,” noted Shoenfeld. This sentiment is driven largely by an explosion in the pre-filled cartridge segment. Almost 250 brands operate in the three states today, compared to just 160 in 2015. Expect that number to grow in 2017.

The power of the pen: affordable and interchangeable

Although vapers compose a large segment of dispensary customers, selling the devices in dispensaries has remained elusive. Currently, vape hard goods represent only a small percent of overall sales. Most vapers still buy their hardware from head shops, online, or direct from the manufacturer. “In the last twelve months, vaporizer devices accounted for $14.5 million in sales—or just 10 percent of total vape sales,” Shoenfeld said. Of those sales, most were pen devices that are more affordable and, of course, interchangeable, he noted.

“Pen-style vaporizers have allowed an abundance of competitors to emerge that supply both the battery/device as well as the concentrates sides of the equation,” said Shoenfeld. “In the future, expect to see more proprietary delivery devices that will command higher price points and will keep consumers locked into their proprietary formats.”

New form factors, like the JUUL (launched by PAX Labs), have deviated from the so-called “cig-alike,” which has been in vogue the past few years. This trend has proved disruptive to the category. Sasha Kadey, chief marketing officer for distributor Greenlane (formerly VapeWorld), thinks the open-system category will see more innovation, too.

“Consumers are looking for more than a cylindrical, pen-style vaporizer,” said Kadey. “Savvy and intelligent consumers are desperate for something new. We are already seeing this happen on the closed-system side, but the open system side is ripe for this type of disruption. It isn’t as restricted, due to the logistics of finding fill partners state by state.”

To be sure, “innovation” was the buzzword in 2016. The much-anticipated launch of Firefly 2, a convection-based vaporizer, introduced patented dynamic convection technology, assuring only plant heats up when the user inhales. “Convection is superior, I believe, because as you inhale you only heat what you want to use,” Firefly Chief Executive Officer Mark Williams said. “You can take small puffs, and there’s no waste.”

Then there’s The Summit+ by Vapium, which is geared toward outdoor enthusiasts. The vaporizer offers first-of-its-kind IP54 splash-proofing and dust-resistance. However, according to Kadey, Grenco Science’s Elite may be the most striking example of form factor innovation.

“With advanced ergonomics, [Grenco Science’s] large investment in design brought to life an entirely new look in the world of hand-held vaporization ,” noted Kadey.

In addition, 2016 saw an increase in limited-edition collaborations. Grenco Science teamed with Snoop Dogg, New York artist Phil Frost and Burton snowboards, and Natalie “Badwood” Wood for product launches. PAX and Bloom Farms worked together on the PAX Era, a big success: PAX supplied the hardware; Bloom Farms the oil.

“The launch of PAX Era has been very similar to the launch of PAX 1 in that it has changed the consumer experience for the better,” said Tyler Goldman, chief revenue officer for PAX Labs. “The company has spent years and millions of dollars on [research and development] to create a total jump in experience with the PAX Era.”

2017: Operation Dispensary

After several successful ballot initiatives in November, dispensary traffic is expected to increase—and so should vape sales.

“I think [the category] offers a lot of growth potential,” said Kadey. “The real challenge for us is convincing the dispensary operators that there is a big opportunity for them to increase revenue by selling retail merchandise in a way that doesn’t distract their budtenders. With little exception, they are solely focused on selling the plant in its various forms. I can understand why, but it’s akin to a salon that sells services but no products.”

In short, Kadey said she believes dispensaries easily could increase their revenue by as much as 10 percent to 20 percent per checkout with the right retail program.

Welcome to Vapelandia!

(Check out Over 45 New Vape Products: The Ultimate Buyer’s Guide)