Make no mistake: 2022 will be a pivotal year in cannabis.

We are (cautiously) emerging from the pandemic as a stronger industry. The chaotic past two years tested cannabis’s recession mettle, and we proved remarkably durable. According to analytics firm BDSA, 2021 saw 41-percent year-over-year growth in global sales ($31 billion) and 38-percent growth from 2020 in the United States ($24 billion).

Without question, the cannabis industry is now international. With both Mexico and Germany announcing legalization in 2021, we’re expecting to see more nations move away from ineffective, prohibitive policies and toward medical and adult-use markets. At home, dueling bills from Democrats and Republicans may set the stage for a bipartisan federal legalization push on an issue about which 91 percent of Americans agree, according to an April poll by the Pew Research Center. More states east of the Mississippi are poised to transition from medical to adult use, and the shift could start to chip away at California’s long-held dominance as the gold standard for brands, bud, and operations.

American multistate operators (MSOs) have continued to increase revenue, margins, and profit as they stake out their territories and establish their playbooks for the coming years. These companies are taking on debt at increasingly favorable rates and have been actively utilizing real estate investment trusts (REITs) to raise capital through facility leaseback agreements. North of the border, their Canadian counterparts have spent the past couple years licking their wounds, though they are quickly repositioning themselves to capitalize on U.S. federal legalization and continued momentum in Europe. Tech and data platforms to support the industry have flourished, while ecommerce, delivery and, more recently, direct-to-consumer sales now are integrated as part of the cannabis buying experience. Ancillary, non-plant-touching businesses continue to play an extremely important role in professionalizing the industry with bespoke solutions for every link in the supply chain.

Although the road to undoing the historic wrongs wrought by the failed war on drugs remains long, social equity programs designed to support businesses owned by people of color are now ubiquitous in state legalization bills. The programs include preferential license access and increased administrative and legal support, while a growing number of high-profile investment funds for minority- and female-owned companies have emerged to address the biggest issue: access to capital.

In this list of twenty-two cannabis leaders to watch in 2022, mg Magazine spotlights the executives, founders, and advocates we think are poised to make major impacts across vital areas of the industry this year.

Wendy Berger

CEO, WBS Equities LLC

WBSEquities.com

“I love to spot opportunities in chaotic environments. The explosive growth phase of startups is where I shine the brightest,” said Wendy Berger, an accomplished real estate entrepreneur, investor, and member of the Green Thumb Industries (GTI) board of directors.

Since making her initial investment in the Chicago-based MSO in 2014, Berger has played an active role as the company’s real estate expert while GTI continuously expanded its footprint. She also influenced GTI’s corporate social responsibility programs. The company’s Good Green initiative provides impact investments to 501(c)(3) organizations working to reverse harms from the war on drugs, having already issued grants of $75,000 to Philadelphia Lawyers for Social Equity, Innovation Works Baltimore, and Why Not Prosper. More are planned for 2022.

Joe Caltabiano

CEO, Choice Consolidation Corp.

Special purpose acquisition corporations (SPACs) have become increasingly popular over the past year, and many cannabis companies are flirting with the less-orthodox approach to tapping into public markets. One of the SPACs to watch in 2022 is Choice Consolidation Corp., which raised $173 million in a February 2021 IPO and intends to acquire one or more vertically integrated operators within limited-license states. Chief Executive Officer Joe Caltabiano plans to turn the resulting entity into what he dubs a “lean, third-generation” MSO.

Caltabiano is a seasoned cannabis executive. As a cofounder of Cresco Labs, he helped transform the company from a startup into an MSO with more than $250 million in annual revenue.

Jesse Channon

Chief Growth Officer, Columbia Care Inc.

Col-Care.com

From 2013 to 2020, New-York-based MSO Columbia Care primarily was known as a medical-focused organization, with stores and products tucked under the corporate parent brand. That all changed when Jesse Channon was appointed chief growth officer. The former ad-tech executive realigned the fast-growing company with an increasingly recreational national market. Expect to see Columbia Care become one of the most watchable MSOs in 2022.

On the brand side, the company owns a strong private-label portfolio across key categories and recently announced high-profile partnerships with Mike Tyson and Pitbull. Nearly non-stop acquisitions in 2021 brought in more retail, and Channon expects to flip ninety-nine new dispensaries across eighteen markets to Columbia Care’s elegant retail concept Cannabist within the next twelve months.

The most intriguing project underway is Forage, the Clio Award-winning virtual budtender that gathers proprietary consumer query data. “What keeps me up at night is making sure when 2024 comes around, we have laid the foundation to be an incredibly extensive, innovation-forward platform.”

Rogelio “Ro” Choy

CEO, Eaze Technologies Inc.

Eaze.com

California delivery behemoth Eaze has made some critical, business-saving decisions since Ro Choy took the helm in 2019. The serial tech exec pivoted the company from a thin-margin, delivery-only tech platform to a multi-pronged national retailer with forty-two storefront and delivery locations across four states, a nine-brand product portfolio, and a path toward profitability at scale (which remains elusive for major delivery companies across many sectors).

Despite the emergence of strong competition in its home state, Eaze continues to grow at an impressive clip, completing 8 million deliveries to its 2 million registered customers. In addition, its successful Momentum social equity incubator entered its third year in 2021, with Eaze generating more than $10 million in sales for minority-owned brands.

The company’s acquisition of Colorado and Florida retailer and cultivator Green Dragon was hugely indicative of Eaze’s plans for 2022. The company’s expansion to brick-and-mortar retail had some scratching their heads, but Choy said it’s “all about expanding access” as Eaze finds strategic paths to increase margins.

Christine De La Rosa

Managing Partner, The People’s Group

ThePeoplesGroup.fund

“We started as a company built on a social equity framework during a time when social equity wasn’t recognized,” said Christine De La Rosa, who has been advocating for equity within the industry since 2015.

De La Rosa is active nationally as an entrepreneur, investor, activist, and advisor. She serves as CEO for The People’s Ecosystem, chairwoman of the board for The People’s Holdings, and founder of citrus-based CBD brand CBxShield. She has advised local, state, and federal governments on social equity in cannabis and authored position papers for New York, California, and Arizona, offering recommendations for their legalization framework.

In October 2021, she launched the People’s Group LLC, a $50-million fund to “invest in BIPOC- [Black, indigenous, and people of color] and women-led cannabis companies to draw attention to the lack of social equity, capital, and investment opportunities within the cannabis industry.”

“2022 will be the first year our company is fully funded,” she said, “and we’re expanding and working with individuals from all aspects of the business, like government, state, federal, founders, and soon-to-be entrepreneurs.”

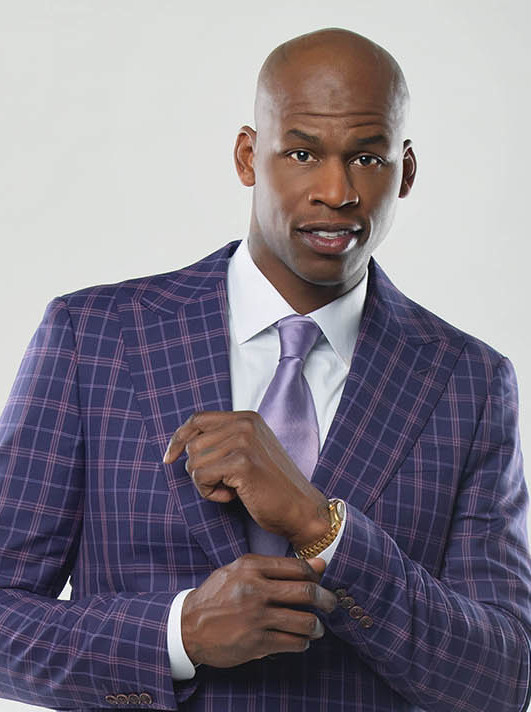

Al Harrington

Founder and CEO, Viola Brands

ViolaBrands.com

Former NBA power forward Al Harrington was among the first wave of former athletes to enter the cannabis industry.

Harrington is arguably one of the most visible and successful Black entrepreneurs in cannabis, and the coming year will see him continue using his considerable influence to support young entrepreneurs of color through the Harrington Institute for Cannabis Education, a collaboration with the Cleveland School of Cannabis.

Laurie Holcomb

Founder and CEO, Gold Flora

GoldFlora.com

Gold Flora, helmed by former real estate developer Laurie Holcomb, is emerging as a major vertical player. The company’s 2016 purchase of twenty-eight acres of land in Desert Hot Springs, California, has developed into a 620,000-square-foot campus housing indoor cultivation, manufacturing and processing, and distribution for fifteen brands in addition to its own high-end flower and vapes.

Holcomb said 2022’s focus will be retail, perhaps “purchasing a string of smaller stores or developing or acquiring new ‘superstores’ in key markets.”

David Klein

CEO, Canopy Growth Corporation

CanopyGrowth.com

Canopy Growth has had a tumultuous run as the largest early mover in the fragmented global cannabis market, at once capitalizing on vast potential and suffering from slow-moving regulation and a chronic imbalance between supply and demand.

When David Klein took the helm in December 2019, the stock had dropped 32 percent since the beginning of the year. Two years later, Klein said he remains “cautiously optimistic” about Canopy’s near-term prospects and staunch in his belief the company is the Canadian entity best positioned to enter the U.S. market.

Aaron Miles

Chief Investment Officer, Verano Holdings Corp.

Verano.com

Verano was among the MSOs that went on a head-spinning expansion spree in 2021. Supported by the business-combination and capital-markets savvy of Aaron Miles, the company racked up fifteen acquisitions in twelve months, positioning itself strongly in major medical markets poised to become adult-use.

Miles is a seasoned investor-relations and finance specialist who took Cresco public in 2018. He has grown so accustomed to the speed and churn of the industry that flexibility is baked into Verano’s philosophy. “We always want to be nimble enough to transition and pivot,” he said. “That’s the hardest part of our job. You can never go into cruise control. We have to make sure we continue to scour for opportunities and improve our operational efficiency.”

With financial discipline, a history of profitability, and self-funded capital expenditures, Verano is negotiating increasingly favorable terms from the capital markets, and this will power the company’s expansion strategy in 2022.

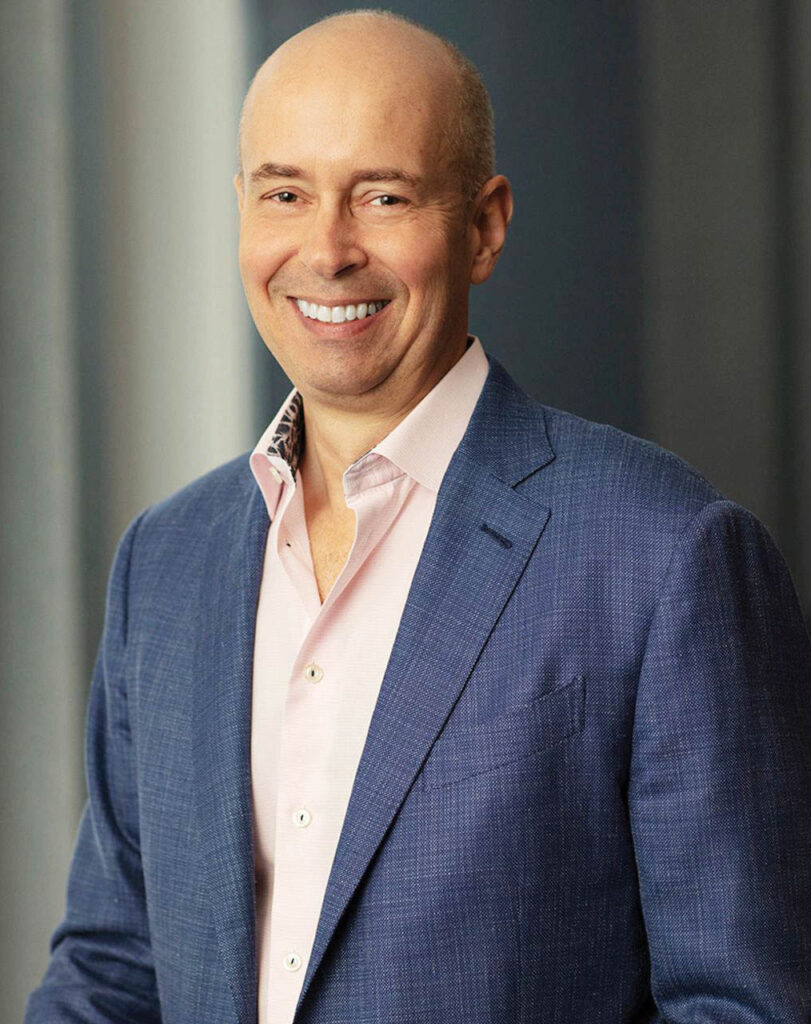

Ross Lipson

Founder and CEO, dutchie

dutchie.com

dutchie is the hottest name in cannabis tech at the moment. The company’s point-of-sale (POS) and digital menu systems power more than $14 billion in transactions across 5,000 dispensaries annually, helping dutchie emerge as one of the industry’s leading tech platforms in the wake of the pandemic-induced shift to ecommerce.

In October, dutchie closed a staggering $350-million Series D funding, valuing the company at $3.75 billion. This year will be pivotal for the company as it seeks to expand its market while maintaining its position on technology’s cutting edge.

Nancy Mace

Republican, U.S. House of Representatives

Mace.House.gov

High-profile Democrats including senators Chuck Schumer and Cory Booker have been introducing federal legalization bills for several years, so action (immediately followed by inaction) in Congress is hardly novel. But South Carolina freshman Republican congresswoman Nancy Mace surprised almost everyone when she introduced a bill aiming to bridge partisan divides with a broadly appealing reform proposal.

Mace’s States Reform Act addresses issues both Republicans and Democrats support and keeps the federal excise tax limit between 3 and 3.75 percent as a way to disincentivize shopping in the illicit market.

Miguel Martin

CEO, Aurora Cannabis Inc.

AuroraMJ.com

Having served in executive roles at tobacco giant Altria and e-cigarette manufacturer Logic Technology, Miguel Martin took the reins at Aurora in September 2020, shortly after the company reported a fiscal-year net loss of CAN $3.3 billion. A year later, the company led the Canadian medical market with net revenue up 23 percent, thanks in large part to cost-cutting measures Martin said were necessary following an “irrational arms race on facilities.”

Aurora’s European division is well-positioned to capitalize on the incoming German government’s plan for adult-use legalization, putting the company’s “transformation plan on track,” Martin said.

Yoko Miyashita

CEO, Leafly Holdings Inc.

Leafly.com

When Yoko Miyashita took over Seattle-based publisher and marketplace Leafly in summer 2020, the company was burning cash and had laid off more than 140 employees. Remarkably, Miyashita—previously the company’s general counsel—guided the corporation to the financial break-even point by year’s end.

This year will see Leafly spring back onto the front foot. The company is set to follow its rival, Weedmaps, in going public, in Leafly’s case via combining with SPAC Merida Merger Corp. at a valuation of $532 million, or around eight times projected 2022 revenue. Miyashita plans to use the capital raised to “facilitate significant investments in our platform, robust advertising tools, and unmatched insights and information.”

Leafly’s ongoing dominance of cannabis-related SEO has given the company a big advantage as a Google-anointed “source of truth” for anyone seeking information about strains, brands, or emerging legislation; this has given Leafly a leg up in the emerging eastern-state markets.

“This year, we’ll continue to grow and develop our key differentiators, including how Leafly establishes a strong foothold in newly legalized, fast-growing markets before they legalize,” Miyashita said.

Mary Pryor

Cofounder, Cannaclusive

Cannaclusive.com

Mary Pryor is one of the most tireless and impactful activists working in the cannabis industry. Through Cannaclusive, the digital platform she cofounded with Tonya Flash and Charlese Antoinette in 2017, Pryor has pushed the industry to acknowledge the historic inequities caused by the war on drugs and “ensure minority consumers are not an afterthought but a valued ally in the fight for legalization and destigmatization.”

In 2022, Pryor and her team will continue building awareness with companies and consumers and will begin a focus on Michigan and New York. “We are working on education and business-focused events for 2022 and are geared toward launching a few products and services that will increase visibility for BIPOC brand owners,” she said.

Kristi Knoblich Palmer

Cofounder, Kiva Confections

KivaConfections.com

Edibles giant Kiva will celebrate its twelfth year in 2022. The longevity can be ascribed, at least in part, to establishing a reputation for reliability and consistency long before those aspects became de rigeur.

Founded by Kristi Knoblich Palmer and her husband, Scott, in their San Francisco Bay Area kitchen, Kiva’s chocolates, gummies, mints, and chews have become some of the most popular products in California, a market often viewed as a bellwether for national success.

Kiva’s self-funded expansion has exported the brand to Arizona, California, Illinois, Michigan, Massachusetts, Nevada, Hawaii, Ohio, and Oklahoma so far, and Palmer sees the East Coast as the next major market.

Kim Rivers

CEO, Trulieve Cannabis Corp.

Trulieve.com

Under the stewardship of CEO Kim Rivers, Florida-based MSO Trulieve has built a reputation for operational efficiency and strategic growth with a deep, narrow focus on key markets.

The recent acquisition of Harvest, an Arizona-based MSO, put Trulieve in an enviable spot among the most profitable U.S. cannabis companies, with the pair posting a combined $317.6 million in revenue and $122.9 million in adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) in the second quarter of 2021. The deal means Trulieve now boasts 149 dispensaries across eleven states and three strategic regional hubs, with Florida, Arizona, and Pennsylvania being the jewels in the crown.

“Trulieve is embarking on a multi-year effort to improve its [environmental, social, and governance] capabilities and quantify and track its progress,” said Rivers.

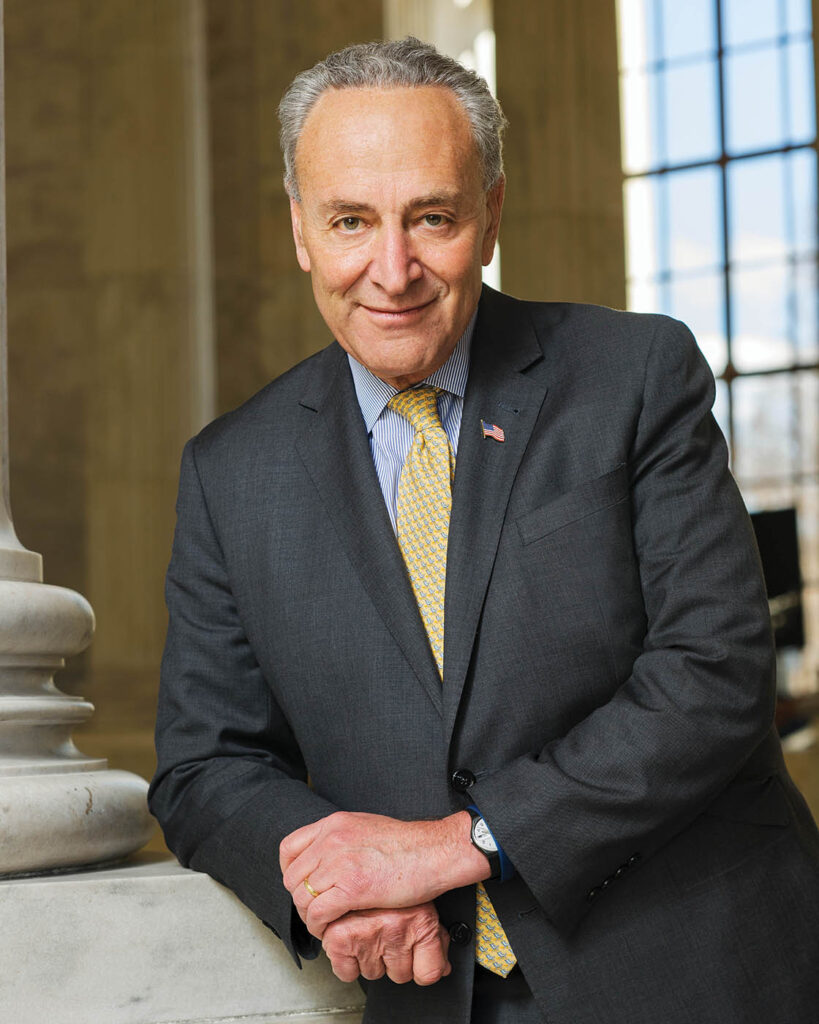

Charles “Chuck” Schumer

Democrat, U.S. Senate Majority Leader

Schumer.Senate.gov

Since the Democrats took back the White House and both chambers of Congress in 2020, the cannabis industry’s best hope for meaningful change sits with New York Senator Chuck Schumer.

Announcing his support for legalization on April 20, 2018, Schumer’s Marijuana Freedom and Opportunity Act was a first step toward legalization; unfortunately, the bill failed to stir much movement from the Democrats’ minority position. Schumer proposed a second piece of legislation in 2021 alongside Senators Ron Wyden (D-OR) and Cory Booker (D-NJ), but broad consensus failed to galvanize around the bill.

An emphasis on social equity is paramount for any bill the Democrats put forward. Schumer has expressed plans to create a federal version of New York’s progressive social equity program, in which the state intends to grant 50 percent of each license variety to social equity candidates.

Paul Smithers

President and CEO, Innovative Industrial Properties Inc.

InnovativeIndustrialProperties.com

One of the biggest issues facing cannabis operators is the fact traditional lenders won’t touch the fledgling, quasi-legal industry. Since its founding in 2016, Innovative Industrial Properties (IIP) has been a credible alternative to traditional lenders. The company holds the distinction of being the first publicly traded company on the New York Stock Exchange to provide real-estate capital to the industry.

Led by president and CEO Paul Smithers, the San Diego-based REIT owns seventy-six properties comprising approximately 7.5 million rentable square feet across nineteen states. IIP has financed a wide variety of deals for just about every major MSO.

“In the coming year, we’re focused on continuing to execute our business model and creatively working with our tenant partners to support them with strategic real estate capital as they ramp up operations in states with existing regulated cannabis programs, as well as expanding into states that have recently legalized and regulated cannabis,” Smithers said.

Irwin D. Simon

CEO, Tilray Inc.

Tilray.com

Another massive Canadian licensed producer repositioning itself for a resurgence in a global marketplace, Tilray’s 2021 merger with Aphria created Canada’s biggest cannabis company by revenue and installed Irwin D. Simon in the hot seat as CEO.

When the deal with Aphria was announced, Simon told investors, “Tilray is poised to strike and transform the industry with our highly scalable operational footprint, a curated portfolio of diverse medical and adult-use cannabis brands and products, a multi-continent distribution network, and a robust capital structure to fund our global expansion strategy.”

The past year also saw the company make some major U.S. bets after it acquired warrants for 21 percent of retailer MedMen (execution contingent upon federal legalization) and closed on a deal for Georgia-based craft brewer SweetWater at around $300 million.

Although Tilray has racked up ten straight quarters of adjusted EBITDA growth, analysts see another major acquisition as Simon’s only logical path toward the company’s 2024 annual revenue goal of $4 billion.

Jason Wild

Executive Chairman, TerrAscend

TerrAscend.com

Jason Wild doesn’t mince words. “The best products win,” he said, explaining TerrAscend’s recent acquisition of Gage, a rapidly growing retailer, cultivator, and Cookies licensee in Michigan. Wild saw the $545-million purchase as an investment in quality genetics, operations, and licensed products in a competitive, high-growth market.

The pharmacist-turned-investing-savant knows a good opportunity when he sees one. Through his fund JW Asset Management, Wild was a seed-stage investor in Fyllo, a cloud compliance and advertising intelligence platform for highly regulated industries that could become cannabis’s next tech unicorn. Already the exclusive licensor of Cookies in New Jersey, TerrAscend seems primed for exposure to fast-rising minority-owned brand Pure Beauty through Gage.

In 2022, Wild’s collaboration with five-time NBA all star Chris Webber and fashion entrepreneur Lavetta Willis, Webber Wild Fund, will start to deploy $100 million to assist companies owned by people of color. The fund already has a full pipeline. “I think there’s a couple of unicorns in there,” Wild said.

William “Bill” Toler

CEO and chairman, Hydrofarm Inc.

Hydrofarm.com

According to New Cannabis Ventures’ Ancillary Cannabis Index, the sector of businesses supporting cannabis outpaced the growth of the overall market in 2021, with Hydrofarm leading the pack. The Pennsylvania-based manufacturer and supplier of controlled-environment cultivation equipment has become an ancillary giant as both companies and consumers continue to demand consistent, high-potency indoor flower.

Hydrofarm is led by Chairman and CEO Bill Toler, a thirty-five-year veteran of CPG and supply-chain management, whose resume includes key roles at Campbell Soup Company, Nabisco, and Procter & Gamble. Under Toler’s guidance, Hydrofarm acquired five cannabis ancillaries in 2021, showing intent to join ScottsMiracle-Gro subsidiary Hawthorne as a big name in lighting, controlled-climate solutions, and soil and nutrients.

In the latest earnings call, Toler said the company expects to see cannabis oversupply in California and Canada contribute to slower growth for Hydrofarm, but he still projects “two-year growth of over 75 percent” as the company increases sales and drives consolidation in its sector.

William “Beau” Wrigley II

Chairman of the Board, Parallel

LiveParallel.com

Beau Wrigley’s entry into the cannabis market in 2019 was a legitimizing moment for an industry on the verge of becoming a mainstream CPG powerhouse. Scion of the chewing gum dynasty, Wrigley’s name is almost synonymous with family-friendly CPG.

Despite impressive performance, his Atlanta-based MSO Parallel—which operates dispensaries in six states—made headlines in late 2021 after its proposed $1.9-billion SPAC merger with music industry magnate Scooter Braun’s Ceres Acquisition Corp. collapsed, reportedly because some investors feared the company couldn’t meet its aggressive financial projections.

Parallel entered Illinois last year with the purchase of six Windy City dispensaries in Chicago for a total of $100 million. The company foresees owning fifty-seven dispensaries across the country by the end of 2022.

But Texas is the state to watch. In April 2021, Wrigley announced Parallel—which owns one of only three licenses in the state—will pour $25 million into a 63,000-square-foot cultivation, production, and retail facility outside San Antonio.

[…] events attract policymakers, corporate leaders, and entrepreneurs from more than 80 countries to connect businesses seeking capital with seasoned […]

[…] the United States industry continues to expand, business leaders seeking protection for their assets are examining new insurance strategies that cover the unique […]